Life Insurance

How Much Life Insurance Benefit Do I Need?

Before we answer that question, let’s consider what your beneficiaries can use the money received upon your death can be used for. In short, the answer is “anything.”

To be more detailed, Life Insurance benefits, upon your death, can:

Provide a lifetime income stream for your family

Pay for your final expenses (funeral and other costs)

Provide liquid assets that your executor can use to settle your affairs without selling anything

Pay off debts due immediately upon your death, like a car loan

Pay off your mortgage, and other debts you may have

Provide an inheritance for your children or grandchildren

Provide an endowment for your favorite school or non-profit organization

Provide for those big expenses in life; childcare, a college education, a child’s wedding

Fund your family’s budget for many years to come

Offer ready funds for your business

And many other uses

Beginning to Think About How Much Life Insurance Benefit You Should Choose

The answer to this question is different for each of us, depending on many factors specific to our life, family, our income, etc.

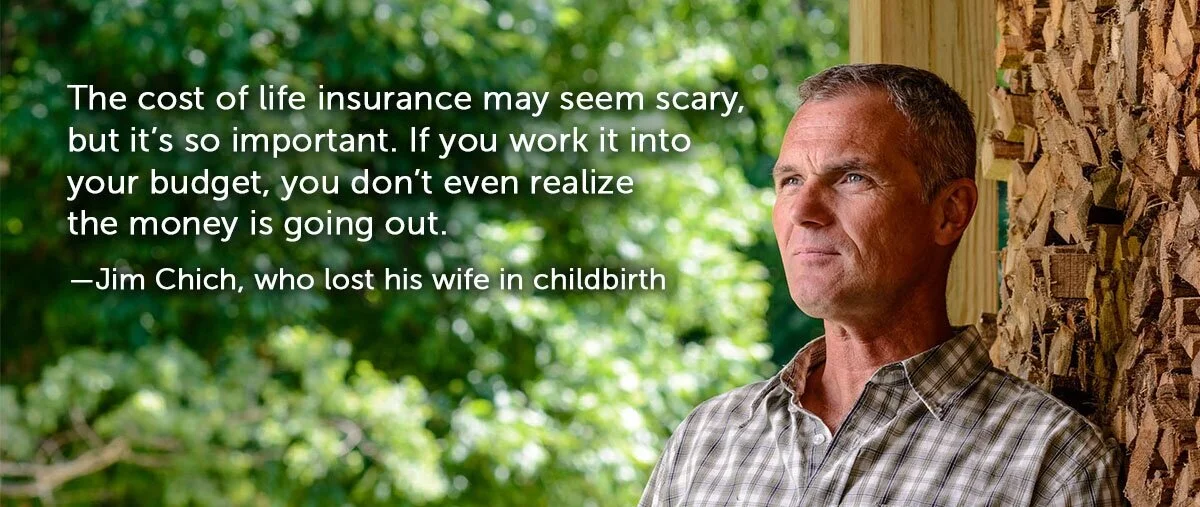

This great video from one of the life insurers we work with, Ohio National Life, is a great way to begin visualizing the need:

Calculating the Life Insurance Benefit for Your Policy

The expenses of “daily life” can really add up over 10-50 years, so you want to correctly determine the Life Insurance benefit your beneficiaries will need if you are no longer there to protect them.

A lot of people, as they tackle this question, think they are choosing too much, almost feeling embarrassed about it… why would their family ever need $250,000, $500,000, $1 million or more at one time? That does sound like a lot of money, but they receive the monies at one time, to be used over time. Imagine if one of those amounts had to pay for a funeral, retire credit card balances, a mortgage, and other debts, pay ongoing expenses for many years, put your children through college…in other words, support your loved ones for many years to come. Would even those amounts be enough? How would you know?

There are two main ways of choosing an adequate Life Insurance benefit; 1) Adding up the costs to be covered, and 2) Choosing a benefit amount that can replicate the deceased person’s income indefinitely, to make sure the family budget can be funded just as it was before the person died.

1) Adding Up The Costs:

To start, estimate what your family members would need after you’re gone to meet immediate, ongoing, and future financial expenses Then, add up the resources your surviving family members could draw on to support themselves. These would include things like a spouse’s income, accumulated savings, life insurance you may already own, etc. The difference between the two is your need for Life Insurance. (try the calculator to run the numbers)

This mathematical equation may seem simple enough, but coming up with all the inputs can get tricky. Plus, you’ll need to factor in the effects of inflation and assumptions about how much your investments will earn over the long run. Plus, what if you miss something? A family figuring the amount 20 years ago would not have known to figure for a monthly cell phone bill!

2) Replicating an Income:

Your family budget is most likely funded by one or two incomes (if both you and your partner both work). In this option of determining Life Insurance benefit we choose an amount of money that could fund the family budget, so that the budget continues without interruption, even if a spouse died. The Life Insurance policy’s death benefit replicates the deceased family member’s income for a period of years; 10, 20, 30, etc.

Example:

A married couple with 2 children, each adult working with an annual income of $45,000. The $90,000 income allows the family to pay for all the ongoing expenses in a family, and even save for the future expenses, like college and retirement. To replicate an income each spouse could carry a Life Insurance policy with a $750,000 benefit.

How did we figure that? Let’s say one spouse died, and the other spouse received the $750,000 as beneficiary. The surviving spouse could invest the $750,000, and at an annual 6% return, use the money made in the investment each year ($750,000 x 6% = $45,000)to replicate the second income. Nothing changes financially.

A more conservative beneficiary might just put the money in the bank, with no interest. Then the $750,000 would last almost 17 years ($750,000 / $45,000 = 16.66 years).

A quick way to come to that number in this idea of replicating someone’s income with Life Insurance is to multiply your annual income by 16.67.

Jim and Jenny’s Life Insurance Story

“I really believe that purchasing Life Insurance could be one of the most loving things you cyran do.” -Michael’s brother

Michael, 32, was a fit and healthy family man. As he left to run a 10K race with his good friend, he kissed his wife, Traci, good-bye along with newborn Calvin and “big” sister Josie. He never made it home.

As he crossed the finish line, Michael collapsed and died. The Kovacic family would never be the same.

Thankfully, they had life insurance. Being a young couple and feeling like they were living paycheck to paycheck, it was always hard to want to purchase an insurance policy they hoped they never used. But Michael’s father was an insurance professional who helped people choose Life Insurance.

Michael had a small policy even before he was married. Once they were married and their first child was on their way Michael’s father recommended affordable term life insurance to replace Michael’s income in case something happened to him.

Traci says the hardest part for her was knowing that the love of her life was never coming home. “But the reality is that everything else stayed the same,” she says. “The paychecks stopped immediately, but I still had to keep the lights on, buy food, pay the mortgage and take care of the kids. Having life insurance meant I didn’t have to make any immediate decisions or sell the house.”

“The life insurance saved us—and it still does today,” she says.

Free Life Insurance Quote

Complete the below form (designed to take you 2-3 minutes) and submit below. We'll send you a free quote of life insurance coverage tailored to your coverage needs! You are also welcome to call us for a quote, or with your questions, (919) 357-6637.

Along with a quote of Life Insurance coverage we will send you this great brochure entitled "What You Need to Know About Life Insurance."

To keep learning more, click here for the next page on calculating the amount of Life Insurance to choose.